Learn how to reach a new level of customer success within your accounting firm, while navigating a new landscape for accountants. Advanced cloud computing gives businesses access to financial statements via email on a pre-set schedule. Business owners will have access to financial documents 24/7, from any device with secure internet access.

Overcoming the Challenges of Becoming a Virtual Accountant

Keeping the books up to date is one of the easiest business tasks to delegate effectively. For startups that have a lot of customers or a lot of bills, virtual bookkeepers can save many hours every month. Online accounting services can easily scale to meet the needs of your business. A virtual accountant can quickly adjust to an increase in work volume, like increased transactions or complexity.

Sharpens your Decisions by Leveraging Key Financial Metrics

Use LinkedIn to network with other professionals and join industry-specific groups to stay connected with trends. Consider offering free webinars or writing a blog on accounting cash flow topics to showcase your expertise and attract potential clients. Start with a degree in accounting, finance, or a related field, which provides essential knowledge of financial principles, tax laws, and accounting standards.

Use these Steps to Start a Virtual Accounting Firm Successfully

To get paid, you need a software solution that lets you receive your money in one piece. That’s where systematizing your business processes comes in handy, frees up more hands to deliver client work with speed, accuracy, and consistency. Sharing your accounting knowledge creates awareness and builds trust in your prospects which might be all you need to get clients walking through your doors.

Supercharge your business’ finance journey

Most virtual accounting firms have processes and procedures in place to be able to offer clients detailed reporting on an agreed upon schedule. You are also likely to receive timely alerts about any pending items that need to be addressed. Additionally, virtual CPA firms can help update your business of any changes in the regulatory and compliance environment. Virtual bookkeeping services work with small to medium-sized businesses, startups, freelancers, and entrepreneurs. They manage financial records and handle bookkeeping https://www.bookstime.com/ tasks for clients across various industries, utilizing digital platforms and cloud-based tools for efficient and accessible financial management.

You’re our first priority.Every time.

- With Live Expert Full-Service Bookkeeping we pair you with a dedicated bookkeeper who will bring your books up to date and then manage your monthly books for you, so you can focus on your business.

- Start with a reliable, high-performance computer that can handle multiple accounting software applications simultaneously.

- They don’t have to travel to every site; they can process everything remotely using secure cloud-based software.

- Remote teams do not care about office cleaning, rent, or conference rooms getting booked.

- If you’re ready to start, here are the steps to set up your online business.

- Learn how you can use BILL’s accounts payable software to automate your processes.

But online accounting firms depend almost entirely on the internet to attract and convert clients. Nobody was ready until COVID-19 came, and suddenly, progressive accounting firms made the switch overnight. Going remote also makes you more accessible to businesses that require the unique accounting services you provide but live miles away from you. Every virtual bookkeeping service should have an option that includes this.

- We believe everyone should be able to make financial decisions with confidence.

- While you might need to invest more into technology and security than a brick-and-mortar office, it’s typically cost-effective to forego traditional office space and the monthly expenses that come with it.

- Nearly one-third (30%) projected reducing their office footprint post-pandemic.

- Fortunately, remote teams can also enjoy team communication (thanks to tools like Slack).

- If you want to be able to work for a client for years without meeting them, meeting software solutions will make sure of that.

- A virtual accountant can help you stay organized, keep your accounts safe, and give you valuable information on your business’s current standings.

- For many, remote work has become the new norm, whether that’s working from home for an employer, or as a service business owner.

Paid advertising, blogging, PPC, social media, and email marketing are some of them. When requesting client files, your client will not need to sign up to share files with you, and you can add information that clarifies what they need virtual accountant to do to get their files across to you. And if you want, you can access the meeting transcript at the end of the call, although you may need to edit it for accuracy.

Why hire a virtual bookkeeper?

- Likewise, if your virtual accountant is communicative, friendly, and professional, they are more likely to deliver a positive experience.

- For instance, Dext allows accountants and business owners to electronically capture and store the files they need for financial compliance.

- Be sure to find an accountant experienced with your size of business, and with your industry.

- Profit from the knowledge and experiences of industry experts and firms that have grown with globaltalent solutions.

- Your bookkeeping service will be able to review your financial transactions from anywhere in the world and be able to collaborate with you more effectively.

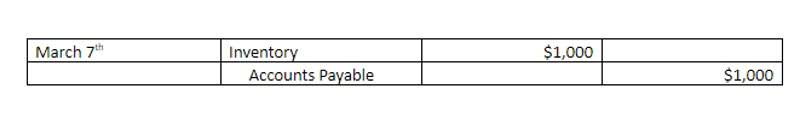

Depending on where you live, commuting can take hours of your day. As a virtual accountant, you can work from home, in a hotel room, coworking space, or coffee shop. Your office is wherever you are, so you don’t waste hours of your day commuting to the office or driving to a client’s office. Ask another business owner if there’s a bookkeeping service they recommend or if there’s a virtual bookkeeping service they should avoid. A virtual accountant can do everything that a normal accountant would be able to do for you as a business owner. A virtual accountant works with you to set up your books, keeps your records accurate and current, and provides A/R and A/P tasks.

Personalized expertise focused on your success

A virtual accountant generally earns between $50,000 – $100,000 per year, though this can vary based on factors such as experience, expertise, and the complexity of the services offered. Experienced or highly specialized virtual accountants may earn over $100,000 annually, especially if they handle high-demand or niche services. Identify a niche market, such as small business accounting, tax preparation for freelancers, or financial consulting for startups, to differentiate yourself. Specializing allows you to tailor your services to meet the unique needs of your clients, making you an expert in your chosen area and helping you command higher fees. Compared to hiring an in-person, in-house accountant, a virtual accountant costs less to get the same work done.